An Inefficient Tax

From the statements of Defense Minister Ivan Anušić and President Zoran Milanović, it is clear that the political and military leadership view the institution of compulsory military service primarily as a means of replenishing the military reserve – a force that, in the event of war, could rapidly support the operations of the professional army. Upon completing basic training, all conscripts are classified as reservists.

There’s No Free Lunch

Nobel Prize-winning economist Milton Friedman often stated to policymakers that “there’s no such thing as a free lunch.” His point was simple: the Government cannot provide citizens with any good unless someone bears the full cost of providing it. The military reserve is one component of the defense and external security services that all citizens of a nation enjoy as a public good.

The first law of economics is that resources are scarce – human wants always exceed the resources available to satisfy them. Conscripts and reservists demand compensation because they could have used resources, namely, their time, in other ways had they not spent them in the military. A high-school graduate could have spent the summer working as a waiter on the Adriatic coast. A bricklayer or a doctor could have been earning income and experience in the profession they’d gone to school for.

A reservist called up for military training is entitled to full pay from their civilian employer – but if he had planned to use those days as leave from work to spend time with family, that time is gone. Pity the man who had already paid for a vacation package before his call-up papers arrived.

Who Pays the Cost?

In a world of scarce resources, every decision involves a cost. Economists define opportunity cost as the value of the best alternative forgone when a choice is made. Several such examples were mentioned above.

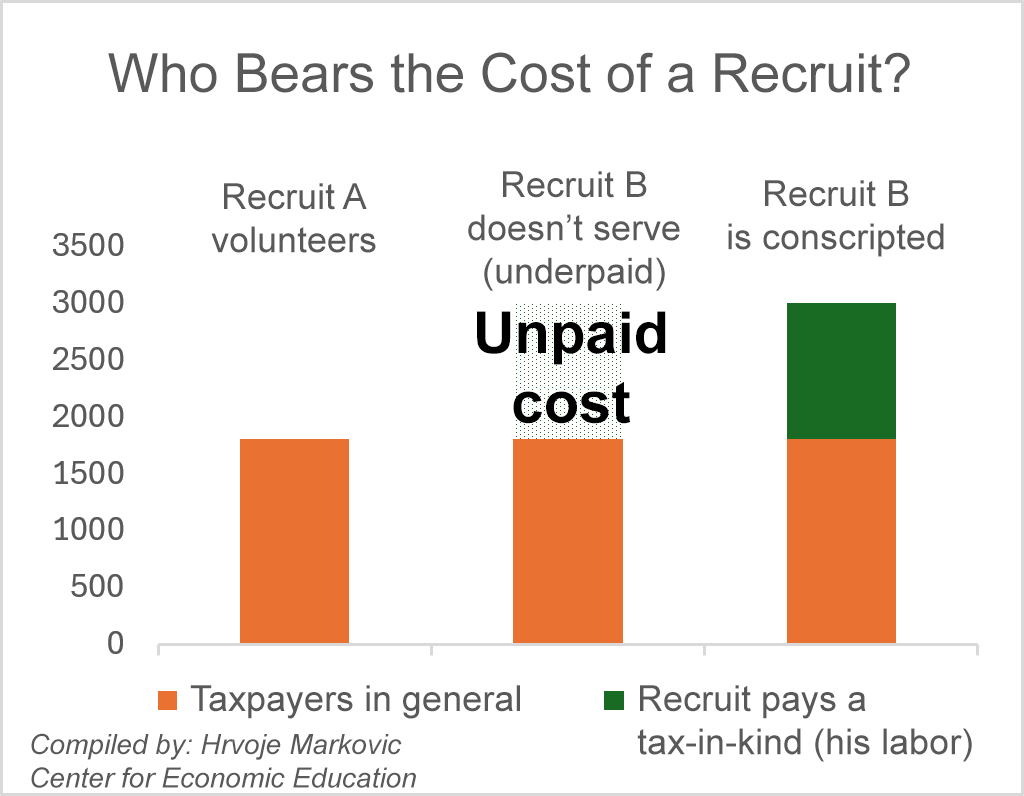

Under Croatia’s current system, in place since 2008, the compensation paid to recruits (currently €1,800 for two months of training) fully compensates their opportunity cost. We know this because if better opportunities were available, they would not volunteer for basic military training.

However, the chronic shortage of voluntary recruits indicates that, for many potential recruits who do not apply, the opportunity cost exceeds the offered compensation. In other words, the pay is too low – for them individually and for the pool of potential recruits as a whole.

In a political democracy, compulsory military service allows the public to enjoy defense and security without fully compensating conscripts and reservists for the cost of their labor and readiness. This is certainly an alluring prospect for those who would prefer to pay lower taxes. But there’s no such thing as a free lunch.

In a voluntary system, general taxpayers fully cover the cost of defense services. But when the body politic compels a potential recruit – who would perhaps only serve voluntarily for €3,000 – to do so for €1,800 under threat of fines or imprisonment, the recruit himself pays the remaining €1,200. He is subsidizing the rest of society by paying a tax – albeit a tax-in-kind – but the form of payment does not change the nature of the transaction.

The Problems of Taxes-in-Kind

Economically speaking, compulsory military service is a tax-in-kind. It is the same type of relationship that existed when Yugoslavia in the late 1940’s forced farmers to sell agricultural goods to the state below market prices. Such taxes are not new – for much of history, peasants were subject to labor rent or corvée, the obligation to work for their lords without compensation. But taxes-in-kind bring three serious problems.

First, they often cause serious inequality by placing the burden of a public good on a small number of people. In economics, this is known as the free-rider problem. Just as paying passengers on a train or bus cover the cost of fare-dodgers, conscripts bear the cost of defending those who do not compensate them for their services.

Second, they distort both taxation and spending, hiding the true cost of public services from citizens and officials alike. Taxes in kind do not appear as items in the state budget, but they are still both public revenue and private expenditure – money is merely a means through which people exchange their labor and capital.

Third, and most damaging economically, they deprive individuals of the freedom to choose how to use their labor. People differ in their talents and abilities. Conscription ignores the principle of comparative advantage, misallocating labor and imposing indirect costs on the whole of society through a reduction in overall productivity.

All of society benefits when the baker bakes bread, the teacher teaches students and the doctor treats patients. Some citizens have the aptitude and motivation to undergo military training and serve periodically as reservists – but many do not. Forcing every young man to serve in the armed forces makes no more sense than forcing every citizen to train as a bulldozer operator, police officer, or thoracic surgeon, even though there is a clear need for public infrastructure, policing, and healthcare (even in, and arguably even more so during wartime). Finally, individuals are certainly more informed of their own individual capabilities than a politician or government bureaucrat.

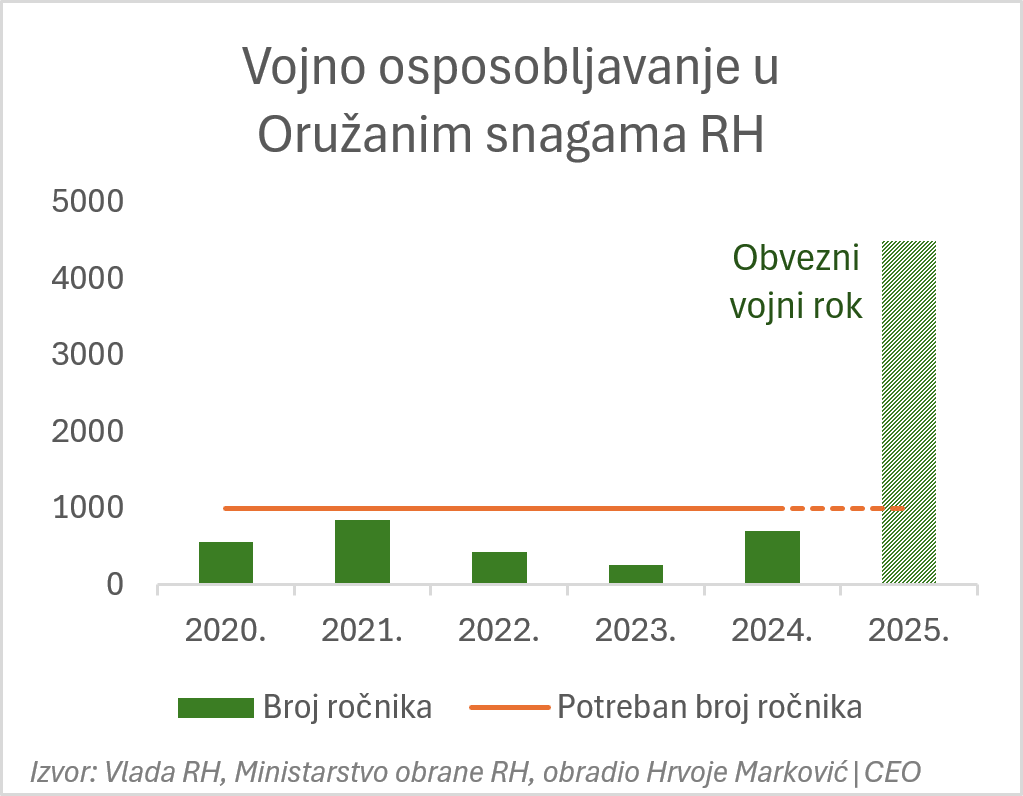

Conscription also produces inefficiencies within the military itself. The Ministry of Defense projects that it would train 4,000–4,500 conscripts in the first year. Yet the minister himself has said as recently as October 2024 that 1,000 volunteers per year would suffice to meet all the Armed Forces’ needs – both professional and reserve components. The labor of officers and NCOs would thus be wasted on training an excess of underpaid and unmotivated conscripts.

The Advantages of a Voluntary Reserve

Under a voluntary reserve model, military training is part of a contractual relationship in which recruits and reservists agree to serve for a defined period as needed – just as those who have already completed either mandatory or voluntary service remain in the reserve today.

In return, taxpayers pay a market-based compensation for their service – whether for training, readiness during their contractual term, or a combination of both. Anything less would mean enjoying the benefits of defense without paying its full cost; in other words, claiming rights without shouldering obligations.

One of the great achievements of civilization was the abolition of the power of rulers and nobles to compel forced labor from their subjects. Replacing taxes in kind with taxes in money enabled the specialization and division of labor, allowing each person to engage in the work that creates the most value – not only for themselves, but for society as a whole.

Such a society is wealthier – and therefore capable of sustaining a better-equipped, more effective military reserve if that is the desired policy effect. This is why compulsory military service would – from the viewpoint of its supporters – result in a state of affairs even more undesirable than the previous state which it was intended to alter. Once all the costs are accounted for, the advantages of an adequately funded voluntary reserve are undeniable. The size and role of the reserve relative to the professional force is a question of ends, whereas compulsory vs. voluntary military service is a question of means to satisfy those ends.

An Unjust Tax

Advocates of reinstating conscription often claim that every young man has a duty to serve his country. As the previous discussion proves, the real question is not whether such a duty exists, but whether it applies equally to all citizens. Is it fair and just to impose a large tax on a small fraction of our young men merely to spare all other taxpayers from paying slightly higher fiscal taxes?

Beyond being discriminatory, conscription is a regressive tax: it falls disproportionately on citizens with lower earnings, just as they are entering the labor market. The benefit they receive in the form of national defense is not proportional to the cost they bear. Most importantly, this tax demands payment in-kind through forced labor.

It is difficult to imagine any member of Parliament ever proposing a general tax as arbitrary and inequitable as conscription. If such a tax were proposed, it would never pass. If it did pass, it is hard to imagine the courts deeming it constitutional. This hidden tax survives only because it is so poorly understood.

No tax is perfect, but it is difficult to imagine any system for distributing the costs of defense – or of any government service – more contrary to the accepted standards of justice, equality, and freedom in a non-totalitarian state.

Before you go…

We are entirely funded by donations from private individuals. Your support allows us to do even more. Thank you!